Starting Off and Funding

Risk management is a critical part of spread betting. If you read Market Wizards and other such books they all state to succeed you need to have great belief in yourself, and work extremely hard at it, and have almost complete dedication to it. I’m sure that if you look at the successful traders they have those traits…they also control risk. It’s one thing developing a plan but it’s a whole different ball game having the calm to play it out…

In fact before we get into more detail on the mechanics of spread trading it is vital that you understand and appreciate the importance of money management in trading. Risk management is that area of your trading that tells you how much of your capital to risk on any one trade. In this respect, it is one area of your trading that you can control. Think about that for a moment. Picking winners is important but even with all the technical analysis in the world no on is able to consistently pick 100% winners. Good money management will see a 50% winning, 50% losing spread betting system make money, however a success rate between 60% and 70% winning should be your ultimate goal.

“Your primary aim should be to preserve your capital. We all trade to earn money, but our ultimate goal is to preserve the money we have. You protect your precious capital by sizing your trade according to your account size. You protect your trades against increasing losses by utilising stop loss orders. Remember, if you lose your money, you are out of the game and you won’t be able to make money.”

- While learning, keep your risks small.

- While learning, keep your leveraged exposure under 1:3.

- Risk management is the aspect that is most overlooked with new traders.

- Risk management will help you survive.

- Risk management will help in improving your profits.

Remember that IF:

You don’t manage risks…

You will lose.

You follow tips blindly…

You will lose.

You don’t make your analysis before your speculate…

You will lose.

You panic…

You will lose.

You are greedy…

You will lose.

You place all your eggs in the same basket…

You will lose.

You can’t afford to lose…

You can’t afford to make a profit.

Without good and disciplined money management you can quickly lose your entire trading fund. Of course that is not why we trade so let me take you through some important money management techniques -:

- Choose a manageable amount to trade with.

Remember all forms of trading; be it day, swing or position trading bring with it a level of risk and you should only look to trade with funds that you can afford to lose. Next you need to decide on the decision-making process you want to use (technicals? fundamentals? combination of both technical analysis and fundamental analysis?)

- Make sure you have the time to trade.

Trading requires time and effort to get it right. If you are in a rush to go to a meeting then you probably don’t want to enter a trade just before you leave while your mind is on something else. It is best to be able to sit and watch the markets to decide when to enter and when to change or close a trade. This is especially important if you are intraday trading.

Money management is a vital part of your trading system. Used correctly it will give you control over your trading and keep you trading.

We need money management to balance the Risk and Reward to balance losses. Good money management is all about controlling your losses (after all there will always be losses). It is very important when you begin trading to accept that you will never get every trade right; you won’t – there will be losing trades. This is all part of being a trader. The key is to limit the losses as best you can and balance them with good money management. All successful traders follow a strict money management plan.

How to apply Money Management

Risk management has other important facets, including trade position size which is vital to proper capital management and needs to be well understood. When it comes to spread trading, money management normally refers to how much money you allocate per each trade. This is also referred to as position sizing. Your money management trading strategy should dictate how much money you should be risking on each trade taking into consideration the expected risk/return.

When trading with large amounts especially if Day Trading it will help you to remember the following calculation:

Trading Fund Size – First you need to decide the amount of your trading fund.

Risk Level – Then you must decide what level of risk you are comfortable with. Ask yourself, what is your maximum percentage risk per trade – is it 1%, 2% or 3%? If you are new to trading and not feeling very confident just yet you could set your risk level to 0.5% or 1%. Experienced traders can trade with risk levels between 3 – 5% and the more adventurous and confident traders trade with a 7 or 8% risk level. However, like I say, if you are new to this or in the early stages of your trading it is best to stick with a lower risk level until you gain confidence.

Once you have set a risk level you must keep it the same during open trading periods.

Trading Size – Once you have decided on the above figures you can now work out your trading size. For example if your Trading Fund is 20,000 and you have decided on a risk level of 1% then your trading size would be 200 (20,000 x 1%). This is the maximum amount you want to risk on each trade also referred to as the Risk Amount.

So now you know the size of your overall trading fund, your risk level and the maximum amount you want to risk per trade.

With this information at hand you can now work out how much to trade per point on your trades…

Let’s assume you have chosen a trade, know your entry price and where you want to place the stop.

The calculation to work out the Price Per Point is as follows:

The risk amount divided by the distance in points between the Entry Price and the Stop Loss gives the ‘Per Points’ price.

The amount to place per point is worked out on the Risk to Stop Loss level.

Let’s look at the following example:

- £20,000 trading fund in account.

- Risk level is set at 1% = £200 risk per trade (Risk Amount).

- So if we enter a LONG trade at 540 and the stop loss is at 520 this gives us a 20 points difference.

- We divide the risk £200 by 20 (entry/stop difference) which gives us an amount of £10 per point.

- If the stop loss was to be set at 30 points away from the entry figure we would divide £200 by 30 and get £6.66. We would round this down to £6 per point.

The distance between the entry level and the stop loss level should be based on the trading strategy that a trader is using. One useful trading tool here is the ATR (average true range). A trader might choose to utilise 3 times the daily average true range as the basis for a stop for a bet to be held for weeks or months. Alternatively, if the trader intends just to hold the position for a few days, an ATR of just 1 to 1.5 should be more appropriate.

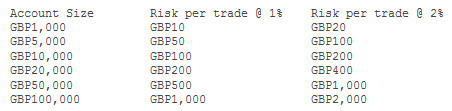

The table above provided by Capital Spreads illustrates what happens when you risk 1% or 2% of your account on any one trade. What most people don’t realise is that the less money you have the harder it is to assign risk on any one trade. This means that with an account of £1,000 it is more diffcult to make a gain than with a larger balance. If you have just £1,000 and risk £50 to £100 on each trade, it means that you are effectively putting at risk 5-10% or more of your account (£1,000/£100 = 10%). Van Tharp uses the term ‘gunslingers’ to describe traders who risk more than 4% per trade. On the other hand if you have a £20,000 account balance and risk 1% per trade this means that you are exposed to £200 risk on the trade. Ideally, so as to have a favourable risk/reward combination, you want to be risking £200 (1% of your trading capital) with a target to achieve a £400-£600 (2-3% minimum) return.

Remember, once you have set a risk rate you must keep it the same during open trading periods. It is vital to good trading that you fully understand risk management.

Having this information and calculation will set you apart and put you in a much stronger starting position than the majority of beginners. Many of which just randomly pick an amount to trade per point. This unfortunately leads to losing money much quicker. This calculation will protect your funds and keep you trading longer.

An alternative to the above, or when trading with smaller amounts, is simply to trade the minimum amount allowed per trade thereby reducing your risk but still letting you get in on the gains that can be made.

Note: It’s a bit difficult to limit yourself to a set £pp and 10 point risk unless you stick to trading the same instrument in the same timeframe. Some of the USA stocks have over a 200 point spread so you would be very inflexible with instruments and timeframes. I trade the Dow for only £2pp, or £4pp if I’m feeling very brave, some wins run into 100’s of points so I only need a couple of runners to make a week’s wage.

Risk and Reward

Risk management is all about your risk and reward – how much am I willing to risk to achieve a result? Risk vs reward ties in directly with win vs loss and determines your profitability. So as you can see it is always a questions of risk versus reward. There are also other questions you need to ask of yourself:

- How much risk is acceptable?

- How much am I willing to risk on this trade?

- What is the expectancy of the reward?

- What is the potential reward?

- Is the risk within my boundaries?

- What does my conviction about my trading method base on?

When you are doing your research to find trades (we’ll go into that later) always remember that the Risk to Reward ratio should be at the very least 1:2 and preferably more like 1:3 or 1:4. There simply is little point in risking your money for any less of a reward.

To demonstrate using the above example, this means if you are entering a trade with 20 points to the Stop Loss (your risk) you want to be able to see a potential for profit of at least 40 points or more (your reward) = this is a 1:2 ratio. A 1:3 ratio would be risking 20 points for 60 points profit and so on.

It doesn’t have to actually reach that profit target when you are in the trade but you must at least be able to see the potential from your indicators when doing your research.

Win vs Loss

The win/loss ratio simply shows the number of wins in relation to the number of losses. For instance, you might have executed 100 spread trades with 65 win and 35 losses, which would be expressed as 65% winners and 35% losers or 65/35.

Avoid emotionally internalising your losses. At some point you will be faced with a string of losses, but by using sensible risk management you will be better equipped to handle them both financially and emotionally.

10 trades – 6 wins and 4 losses: This is the type of scenario you should be aiming for when designing your entry and exit strategy. This gives a gross profit of £800, but the focus should be on the win vs loss and risk vs reward ratios illustrated. These risk vs reward ratios are more suited to position and trend traders.

10 trades – 7 wins and 3 losses: This style of risk vs reward and win vs loss ratio is more suited to day trading, where small gains and losses are the norm. If your risk vs reward is in this ratio you need to ensure you have a high probability entry technique. This results in a gross profit of £800.

Remember that you will need to consider your own circumstances when deciding how much to trade.

Not every trade is going to be a winner – some of the best trading systems are right only 60% of the time. So if you’re losing 40% of the time, you will need all the risk tools working in your favour to keep profits up. By not controlling your risk, or using incorrect position sizing, your account may run into trouble quite quickly if you had five losses in a row. You need to think of this aspect of trading very carefully. Below is a chart demonstrating the various position sizing

percentages and how they pan out over 20 consecutive trades.

Examples courtesy of CMC Markets

In the world of trading it is often quoted…

Knowing when NOT to trade is one of the best trading decisions you can make.

This can be the difference in your success as a trader. Never trade just for the sake of it!

Only ever trade when you can see clear signals and strong indicators to trade.

Your financial risk plan should be written into your trading plan and must be acted upon. A good trade is not being right or wrong, but executing the trade according to your plan. This way you can improve your trading.

Capital preservation is the most important rule of trading. Managing your money carefully and controlling your losses is absolutely critical for successful trading. And again the main tool in spread trading you can use to control and minimize your risk is a stop loss level. The KISS principle works great here. Keep things simple, develop a trading plan and, finally, have patience. Stick it clearly in your mind that the only place where patience doesn’t have a place is when dealing with increasing losses!

Jeff Saul, Head of Equities at SaxoBank: “My best advice was when I was working as an equity analyst. I’m by nature a really positive person who sees lots of opportunities and it came from my head of equities at the time. He said to look out for the downside, focus more on the risk side of things and try and have a balanced view. Always think about this: if what you’re considering is such a good idea, why has everyone else not seen it too? When I have this at the back of my head I always try and see if there’s a reason why everyone else has not bought into a story. It’s not just in trading, it’s in all kinds of business I always look at the flip side and think, OK,

what are the risks?